Look, I’m going to tell you about the most expensive mistake I’ve ever seen someone make in real estate, and it happened because nobody bothered to explain that commercial appraisals work completely differently than residential ones.

Three years ago, my client David – successful residential investor, owned 14 rental houses – decided he was ready to “graduate” to commercial real estate. Found this beautiful 12-unit apartment building in Henderson, asking price $1.8 million. The residential appraiser he’d used for years valued it at $1.75 million using comparable sales. David felt confident, made an offer, got accepted.

Six months later, he was hemorrhaging money. Why? Because that residential appraiser had no clue how to analyze commercial income streams. The building looked great on paper, but half the units were rented $200 below market rate on long-term leases, the basement had moisture issues that required $40,000 in repairs, and the previous owner had been covering operating expenses that David suddenly inherited.

A proper commercial appraisal would have caught all of this. The building’s actual value, based on realistic income projections? About $1.4 million. David overpaid by $350,000 because he didn’t understand that commercial properties are valued on completely different principles than houses.

Why Residential Appraisals Give People False Confidence

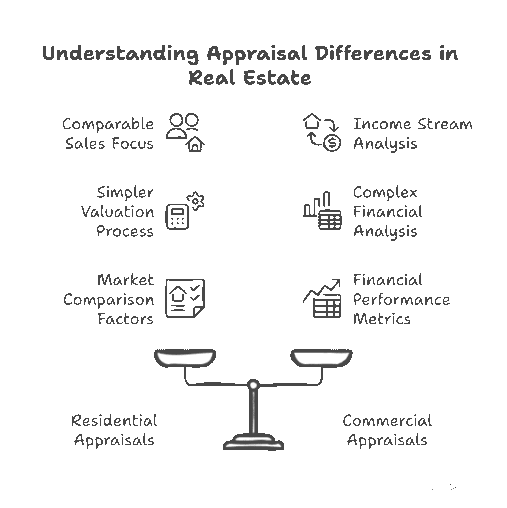

Most people understand residential appraisals because they’re straightforward. Your house is worth roughly what similar houses in your neighborhood sold for recently, adjusted for condition, size, and features. It’s basically sophisticated comparison shopping.

I can appraise most residential properties in 2-3 hours. Drive by some comparable sales, measure the house, take photos, check condition, run the numbers. The math is simple: if three similar houses on your street sold for $350K, $365K, and $370K in the past six months, your house is probably worth somewhere in that range.

This approach works for residential because houses are primarily shelter, not investment vehicles. Most buyers are purchasing a place to live, not analyzing cash flow and cap rates. They care about school districts, commute times, and whether the kitchen is updated – factors that are relatively easy to compare across similar properties.

The problem starts when people take this residential mindset into commercial real estate. They look at a commercial property and think, “I’ll just find some similar buildings that sold recently and adjust for differences.” This approach misses 90% of what actually determines commercial property value.

How Commercial Appraisals Actually Work (And Why It’s More Complicated)

Commercial real estate is valued primarily on its ability to generate income. Period. Everything else – location, condition, curb appeal – matters only insofar as it affects the property’s earning potential.

This changes everything about how appraisals work. Instead of comparing sales prices, I’m analyzing rent rolls, operating expenses, lease terms, tenant creditworthiness, and market conditions. Instead of adjusting for granite countertops, I’m evaluating whether the HVAC system will need replacement and how that affects net operating income.

The income capitalization approach is the heart of commercial valuation. Here’s how it works: I calculate the property’s net operating income (NOI) – total rental income minus operating expenses – then divide by the appropriate capitalization rate for that market and property type.

If a property generates $100,000 in NOI and the market cap rate is 8%, the value is $1.25 million ($100,000 ÷ 0.08). If the cap rate is 6%, the same building is worth $1.67 million. That 2% difference in cap rate represents $420,000 in value – more than most people’s houses.

This is why commercial appraisals take 3-4 weeks instead of 3-4 hours. I need to:

- Analyze 3+ years of operating statements

- Review every lease for terms, renewal options, and escalation clauses

- Verify tenant creditworthiness and payment history

- Research comparable sales AND rental rates in the market

- Calculate appropriate cap rates based on investor expectations

- Model different scenarios for vacancy, rent growth, and expenses

I spent six weeks on a 40-unit apartment complex appraisal last year because the rent roll showed significant discrepancies, several tenants were behind on rent, and the property management company had been cooking the books to hide maintenance issues. What looked like a straightforward income-producing asset turned into a forensic accounting project.

The Three Valuation Approaches (And Why Most People Only Understand One)

Commercial appraisals use three different valuation methods, and understanding how they work together is crucial for making smart investment decisions.

Sales Comparison Approach: Useful But Limited

This is the method everyone thinks they understand because it’s similar to residential appraisals. Find comparable sales, adjust for differences, estimate value. Simple, right?

Wrong. Commercial property sales are rare and often involve unique circumstances that make direct comparison difficult. I might find three “comparable” office buildings that sold in the past year, but one was a distressed sale, another included seller financing at below-market rates, and the third was purchased by an owner-user who paid a premium for specific features.

Even when you find truly comparable sales, the information is often incomplete. Sales prices are public, but the lease terms, operating expenses, and tenant quality that drove those prices usually aren’t. You’re trying to reverse-engineer value without knowing the most important variables.

Cost Approach: The Reality Check

The cost approach estimates value by calculating what it would cost to build the same property today, minus depreciation. It’s most useful for newer properties or unique buildings where comparable sales don’t exist.

This approach provides a floor value – in theory, no one would pay more for an existing building than it would cost to build a new one with similar utility. But it doesn’t account for income potential, which is why it’s rarely the determining factor in commercial valuations.

Income Capitalization: Where the Money Is

This is the method that separates commercial from residential real estate. Value is based on the property’s ability to generate income, period.

The math seems simple: NOI divided by cap rate equals value. But calculating accurate NOI requires understanding dozens of variables that can dramatically affect profitability.

Rental Income Analysis: I don’t just look at current rents – I analyze whether they’re at market rates, whether leases include escalation clauses, when they expire, and what renewal probability looks like. A building with all leases expiring next year is worth less than one with staggered expirations over 5-10 years, even if current income is identical.

Operating Expense Verification: Sellers lie about expenses. Not always intentionally, but owner-operated properties often understate true operating costs because the owner provides services without charging market rates. I verify every expense category – taxes, insurance, utilities, maintenance, management fees, reserves for capital improvements.

Market Rent Analysis: What could the property generate if all units were leased at current market rates? This requires understanding not just asking rents, but actual deal terms – free rent periods, tenant improvement allowances, and other concessions that affect effective rental rates.

The Hidden Factors That Make Commercial Values Unpredictable

Location matters in commercial real estate, but not the way most people think. It’s not about being in a “good neighborhood” – it’s about demographics, traffic patterns, zoning, and economic trends that affect tenant demand and rental rates.

Tenant Quality Is Everything

A building’s value is only as good as its tenants’ ability to pay rent. I spend significant time evaluating tenant creditworthiness, business stability, and lease terms because these factors directly impact income reliability.

National credit tenants – companies like CVS, Starbucks, or FedEx – provide stable income that investors will pay premium prices for. A 10,000 square foot building leased to Walgreens on a 15-year lease might trade at a 5.5% cap rate because the income is virtually guaranteed.

Compare that to the same building leased to “Joe’s Auto Repair” on a five-year lease. Even if Joe pays the same rent, investors will demand an 8-9% cap rate because of the higher risk. That difference represents $600,000-800,000 in value for identical buildings.

I appraised a retail strip center last year where the anchor tenant – a small grocery store – had been struggling for months. The owner insisted the tenant was “working through temporary issues,” but financial statements showed declining sales and missed rent payments. I valued the property assuming that space would be vacant, which reduced the appraised value by $420,000 compared to the owner’s expectations.

Lease Terms Control Everything

Commercial leases are complex documents that can dramatically affect property value. Length, renewal options, rent escalations, expense responsibilities, and termination clauses all impact the income stream.

Triple net leases (where tenants pay taxes, insurance, and maintenance) are more valuable than gross leases because they shift operating risk to tenants. Percentage rent clauses in retail leases can provide upside if tenant sales increase. Personal guarantees from business owners provide additional security if the business fails.

Market Conditions Drive Cap Rates

Cap rates aren’t static – they fluctuate based on investor demand, interest rates, and economic conditions. When interest rates are low and investors are seeking yield, cap rates compress and property values increase. When borrowing becomes expensive or economic uncertainty increases, cap rates expand and values decline.

I’ve seen identical properties trade at 6% cap rates in 2021 and 8% cap rates in 2023 simply due to changing market conditions. That’s a 25% difference in value for the same income stream.

Why Most Appraisers Can’t Handle Commercial Properties

The expertise gap between residential and commercial appraisers is enormous. Residential appraisers need to understand market analysis and property condition assessment. Commercial appraisers need those skills plus financial analysis, lease interpretation, market research, and investment theory.

I hold the MAI designation from the Appraisal Institute – the gold standard for commercial appraisers. Getting this credential required 4,500 hours of experience, 300 hours of coursework, and passing comprehensive exams on valuation theory, financial analysis, and market analysis. Most residential appraisers have never analyzed a lease or calculated a cap rate.

The due diligence process for commercial appraisals is exponentially more complex. For a typical assignment, I:

- Review 2-3 years of operating statements and tax returns

- Analyze every lease for terms, escalations, and renewal options

- Interview property managers about operating challenges and market conditions

- Research comparable sales and lease rates in the market

- Verify tenant creditworthiness and payment history

- Inspect building systems and assess capital improvement needs

- Model various scenarios for vacancy, rent growth, and expenses

This process takes 3-4 weeks for most properties, compared to 2-3 days for residential appraisals. The complexity is why commercial appraisal fees range from $3,000-15,000 while residential appraisals cost $400-800.

Regulatory Differences That Can Sink Your Deal

Both residential and commercial appraisers must follow USPAP (Uniform Standards of Professional Appraisal Practice), but the application differs significantly. Commercial appraisals require more extensive market analysis, detailed income and expense verification, and comprehensive risk assessment.

Lender requirements for commercial appraisals are also more stringent. Most commercial loans require appraisers with specific experience in the property type and market. A shopping center appraisal might require an appraiser with retail property experience and knowledge of local retail market conditions.

Environmental assessments are standard for commercial properties but rare for residential. Phase I environmental assessments identify potential contamination risks that could affect value and financing. I’ve seen deals die when environmental assessments revealed underground storage tanks or soil contamination that would cost hundreds of thousands to remediate.

What This Means for Your Money

Understanding these differences isn’t academic – it directly affects your investment returns and financial risk.

For Investors: Commercial real estate success depends on accurate financial analysis, not just comparable sales. You need appraisers who understand income analysis, lease evaluation, and market dynamics. Trying to save money with cheaper, less qualified appraisers is like performing surgery with a butter knife – technically possible but likely to end badly.

For Lenders: Commercial lending risks are fundamentally different from residential risks. Property value depends on tenant quality, lease terms, and market conditions that can change rapidly. Appraisal requirements should reflect this complexity, even if it means higher costs and longer timelines.

For Developers: New construction commercial projects require specialized expertise in cost estimation, market absorption analysis, and stabilized value projections. Generic appraisals that don’t account for lease-up risk and market timing can lead to construction loans that exceed completed value.

The Smart Money Approach

Here’s how successful investors and lenders approach commercial appraisals:

Use qualified appraisers with specific experience in your property type and market. A strip mall appraisal should be done by someone who understands retail real estate, not someone who mainly appraises apartments.

Budget appropriately for appraisal costs. Commercial appraisals cost 10-20 times more than residential appraisals because they require 10-20 times more work. The cost is trivial compared to making a $200,000+ valuation error.

Allow adequate time for thorough analysis. Rush jobs lead to mistakes. Quality commercial appraisals take 3-4 weeks minimum. If you need faster turnaround, expect to pay premium fees for expedited service.Verify all income and expense assumptions. Don’t rely on seller-provided information without verification. Review actual leases, operating statements, and tenant payment history. Trust but verify everything.