Five years ago, I found myself in one of the most unusual negotiation situations of my career. My client had identified the perfect location for a boutique hotel – a waterfront parcel with stunning views and incredible development potential. The only problem was the asking price: $8 million for the land alone, before even breaking ground on the actual hotel.

The property had been in the same family for three generations. They weren’t motivated by money – they had plenty. What they cared about was preserving their connection to the land while seeing it developed into something meaningful. After weeks of back-and-forth, the grandfather finally said something that changed everything: “We don’t want to sell our inheritance, but we’d be willing to share it with the right partner.”

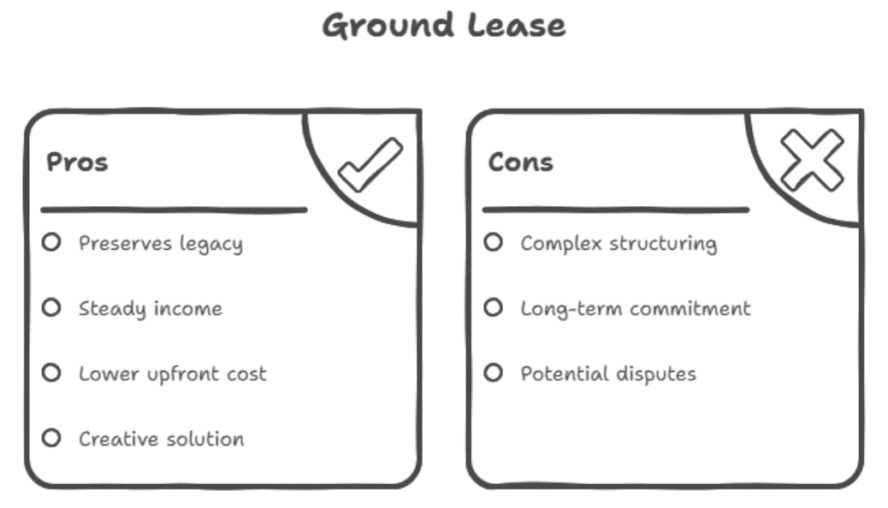

That’s when we shifted to discussing a ground lease. Instead of buying the land outright, my client would lease it for 75 years, with options to extend. The family would receive steady income, maintain ownership of their legacy property, and my client could build his hotel without the massive upfront land acquisition cost. The hotel opened two years later and has been a huge success. More importantly, both parties got what they really wanted.

That deal taught me that ground leases aren’t just financial instruments – they’re creative solutions that can align interests in ways that traditional purchases or rentals can’t. But they’re also complex arrangements that require careful structuring to work properly.

What Ground Leases Actually Are

A ground lease separates the ownership of land from the ownership of whatever gets built on that land. The landowner keeps the dirt; the tenant owns the building they construct during the lease term. It’s like having a very long-term rental agreement for the land, but with the tenant making a major investment in improvements.

The typical ground lease runs 50-99 years, though I’ve seen them as short as 25 years for specific situations. The tenant pays ground rent to the landowner – usually monthly or annually – and has the right to use the land as specified in the lease agreement. The tenant owns any building they construct and can operate, mortgage, or even sell their leasehold interest (subject to lease terms).

Here’s the part that surprises many people: at the end of the lease term, the building typically reverts to the landowner unless other arrangements have been negotiated. This reversion clause is one of the most critical aspects to consider when evaluating ground lease opportunities.

The ground rent structure varies widely. Some ground leases have fixed rent for the entire term. Others include escalation clauses tied to inflation, property values, or preset percentage increases. I’ve seen creative structures where rent increases are tied to the tenant’s revenue or the property’s performance. The key is finding an arrangement that works for both parties over the long term.

Why Landowners Choose Ground Leases

Steady Income Without Losing the Asset

For many landowners, ground leases offer the best of both worlds: regular income from their property without giving up ownership. This is particularly appealing for families who’ve held land for generations, institutions with long-term investment horizons, or anyone who believes their land will be significantly more valuable in the future.

I worked with a church that owned a large parcel in a rapidly developing area. They needed income to fund their operations but didn’t want to sell property that had been donated by founding members decades earlier. A ground lease with a retail developer provided steady cash flow while preserving the asset for future generations.

The income stream from ground leases can be more predictable than other real estate investments. Unlike rental properties that require active management, maintenance, and deal with vacancy risk, ground lease income typically comes from creditworthy tenants who’ve made substantial investments in the property.

Tax Advantages

Ground leases can provide significant tax benefits compared to outright sales. Instead of recognizing a large capital gain immediately, landowners receive rental income that’s typically taxed as ordinary income. This can result in lower overall tax liability, especially for landowners in lower tax brackets than the capital gains rate would trigger.

The depreciation benefits can also be attractive. While the land itself doesn’t depreciate, any improvements that revert to the landowner at the end of the lease may provide depreciation deductions during the lease term. Tax laws around ground leases can be complex, so professional advice is essential, but the potential benefits are real.

Future Upside Potential

Perhaps the most compelling long-term benefit is that landowners eventually get back not just their land, but also whatever improvements the tenant has built. A parking lot today becomes a shopping center in 50 years, and the landowner owns it all free and clear when the lease expires.

I’ve seen this play out dramatically with older ground leases that are now approaching expiration. A family that ground-leased farmland for a shopping center in the 1970s will soon own a valuable retail property worth millions more than the original land value. The tenant got decades of profitable operation, and the landowner gets a fully improved, income-producing property.

The Tenant’s Perspective: Lower Entry Costs, Higher Complexity

Reduced Capital Requirements

For developers and businesses, ground leases can make otherwise impossible projects financially feasible. Instead of tying up millions in land acquisition, they can lease the land and deploy that capital for construction, equipment, or other business needs.

This leverage can dramatically improve returns on invested capital. I recently worked with a developer who was choosing between buying land for $3 million or ground-leasing it for $200,000 annually. By choosing the ground lease, they could invest that $3 million in higher-quality construction and tenant improvements, ultimately creating a more valuable and competitive property.

The math can be compelling, especially in expensive markets where land costs represent a large percentage of total project costs. In some urban markets I know, ground leases allow developers to pursue projects that simply wouldn’t work if they had to buy the land outright.

Financing Challenges

The biggest hurdle for ground lease tenants is usually financing. Banks are naturally more cautious about lending on leasehold interests because their security is limited to the lease term. If the borrower defaults, the bank can only foreclose on the leasehold interest, not the underlying land.

This financing challenge requires creative solutions. Some lenders specialize in leasehold financing and understand how to structure these deals properly. Subordination agreements, where the landowner agrees to subordinate their interest to the construction lender, can help but require careful negotiation.

I’ve found that the strongest financing packages for ground lease projects include detailed lease terms, creditworthy tenants, long lease terms with renewal options, and clear agreements about what happens to improvements during the lease term. The more certainty you can provide to lenders, the more likely they are to finance the project on reasonable terms.

Structuring Deals That Work

Lease Term and Renewal Options

The length of the ground lease term is critical for both parties. Tenants need enough time to recoup their investment and generate reasonable returns. Landowners want to balance providing adequate time for the tenant’s success while not tying up their property indefinitely.

Most successful ground leases I’ve worked on include renewal options that give tenants the ability to extend the lease under predetermined terms. This provides security for the tenant’s investment while giving landowners flexibility for the future. The renewal terms might include rent adjustments based on fair market value at the time of renewal.

One structure I’ve used successfully includes automatic renewal options for predetermined periods (say, two 25-year extensions) with rent adjustments, followed by a final renewal option that gets negotiated based on market conditions at the time.

Rent Structure and Escalations

Ground rent structures need to balance current affordability for the tenant with inflation protection for the landowner. Fixed-rent ground leases that seemed fair at inception can become problematic decades later when inflation has eroded the landowner’s real income.

Percentage rent structures, where ground rent is calculated as a percentage of the property’s income or value, can align interests between landowner and tenant. As the property becomes more successful, both parties benefit. However, these structures require clear accounting and reporting requirements.

I’ve also seen creative structures where ground rent starts low during the development and lease-up phase, then increases to market levels once the property is stabilized. This helps tenants manage cash flow during the riskiest period while ensuring landowners receive fair compensation over time.

Use Restrictions and Development Rights

Ground leases typically include detailed provisions about how the land can be used, what types of improvements are permitted, and what design standards must be met. These provisions protect the landowner’s interests while giving the tenant sufficient flexibility to operate profitably.

The challenge is balancing the landowner’s desire to control what happens on their property with the tenant’s need for operational flexibility. Too many restrictions can make the lease unworkable for the tenant. Too few can result in developments that don’t align with the landowner’s vision or values.

Environmental provisions are increasingly important in ground leases. Both parties need protection against environmental liability, and there should be clear agreements about responsibility for environmental compliance and remediation.

When Ground Leases Make Sense

High Land Values, Patient Capital

Ground leases work particularly well in markets where land values are extremely high relative to improvement costs. In expensive urban markets, the cost of land acquisition can make development projects financially unfeasible. Ground leases allow development to proceed while spreading the land cost over decades rather than requiring it all upfront.

I’ve seen this dynamic play out repeatedly in markets like San Francisco, Manhattan, and other high-cost coastal cities. Developers who might be priced out of land purchases can often make the economics work with ground leases, especially for income-producing properties where the ongoing ground rent can be covered by rental income.

The key is ensuring that the ground rent doesn’t consume so much of the property’s income that the tenant can’t achieve reasonable returns. I typically recommend that ground rent should not exceed 15-20% of the property’s gross income for the deal to work long-term.

Legacy Properties and Institutional Owners

Ground leases are particularly attractive for landowners who have non-financial motivations for holding their property. Family-owned land, institutional properties, or parcels with historic or sentimental value often benefit from ground lease structures that preserve ownership while enabling productive use.

Universities are excellent examples of this dynamic. Many have valuable real estate portfolios but need the land for their educational mission long-term. Ground leasing allows them to generate income from underutilized parcels while maintaining ownership for future campus expansion or other institutional needs.

Churches, museums, and other nonprofits often find similar benefits in ground leases. They can generate operating income from their real estate while preserving assets for their core mission.

Development Projects with Long Payback Periods

Some types of development naturally align with ground lease structures because they require long-term investment horizons to be profitable. Hotels, shopping centers, and large office complexes often benefit from the reduced upfront capital requirements that ground leases provide.

These projects typically take years to develop, lease up, and reach stabilized operations. The ability to reduce initial capital requirements through ground leases can improve project feasibility and investor returns, even accounting for the ongoing ground rent obligations.

Potential Pitfalls and How to Avoid Them

The Reversion Risk

The biggest risk for ground lease tenants is what happens when the lease expires. Unless renewal terms are clearly defined and reasonable, tenants risk losing valuable improvements they’ve spent decades paying for and maintaining.

I always recommend negotiating renewal options at fair market rent rather than leaving renewal entirely to future negotiation. The definition of “fair market rent” should be clearly specified, including the methodology for determining it and dispute resolution procedures if the parties can’t agree.

Some ground leases include purchase options that allow tenants to acquire the land at predetermined prices or fair market value. While landowners are often reluctant to include these provisions, they can provide valuable protection for tenants’ long-term interests.

Financing and Refinancing Challenges

Ground lease financing can become particularly challenging when it’s time to refinance. Lenders’ attitudes toward leasehold financing can change over time, and what seemed like reasonable financing terms at project inception might not be available years later.

The best protection against financing risk is structuring the initial ground lease to be as lender-friendly as possible. This includes long lease terms, reasonable renewal options, minimal use restrictions, and clear procedures for lender protection in case of default.

I also recommend that ground lease tenants maintain relationships with multiple potential lenders throughout the lease term, not just when financing is needed. This ongoing relationship building can provide more options when refinancing becomes necessary.

Use and Development Restrictions

Ground leases typically include restrictions on how the property can be used and developed. While these restrictions protect the landowner’s interests, they can become problematic if market conditions change and the tenant needs to adapt their business model.

The key is building appropriate flexibility into the ground lease from the beginning. This might include provisions for changes in use with landowner consent (not to be unreasonably withheld), expansion rights if additional land is available, or modification procedures for updating lease terms as circumstances change.

Market Trends and Future Outlook

Ground leases are becoming more common as real estate prices continue to rise and capital becomes more expensive. I’m seeing increased interest from both institutional investors looking for long-term income streams and developers seeking ways to make projects pencil in expensive markets.

Environmental considerations are also driving ground lease activity. Landowners who want to ensure sustainable development on their property can use ground leases to maintain control over environmental standards and green building requirements.

Technology companies and data center operators are increasingly interested in ground leases for sites where they need long-term control but don’t necessarily want to tie up capital in land ownership. The predictable, long-term nature of ground leases aligns well with their infrastructure investment strategies.

Making Ground Leases Work

The success of any ground lease depends on alignment between the landowner’s and tenant’s long-term interests. Both parties need to benefit from the arrangement throughout the lease term, not just at inception.

Clear communication and realistic expectations are essential. Ground leases are long-term relationships, and both parties’ circumstances will likely change significantly over the lease term. Building flexibility and fair procedures for addressing changes can prevent future conflicts.

Professional guidance is crucial for both landowners and tenants. Ground leases involve complex legal, financial, and tax considerations that require specialized expertise. The upfront investment in proper structuring and documentation can prevent expensive problems later.

Ground leases aren’t appropriate for every situation, but when they’re well-structured and properly executed, they can create value for both landowners and tenants that wouldn’t be achievable through traditional purchase or rental arrangements. The key is understanding when they make sense and how to structure them for long-term success.

The waterfront hotel I mentioned at the beginning is still operating successfully, the family still owns their legacy property, and both parties are happy with the arrangement. That’s what happens when ground leases are done right – everyone wins, and the success continues for decades.