A few years back, I walked through a shopping center that should have been printing money. Prime location, excellent visibility, solid demographics – all the fundamentals were there. But something felt off immediately. The center was maybe 60% occupied, and the tenants that were there seemed… disconnected. A high-end jewelry store sat next to a discount cell phone repair shop. A family restaurant was sandwiched between a tax preparation service and a vape shop.

The property owner couldn’t understand why comparable centers in the area were thriving while his struggled to maintain occupancy. After spending time analyzing the situation, the problem became clear: there was no strategy behind the tenant selection. It was purely opportunistic – whoever could pay rent and pass a credit check got a lease. The result was a collection of businesses that didn’t complement each other, didn’t serve the same customer base, and didn’t create any reason for people to visit more than once.

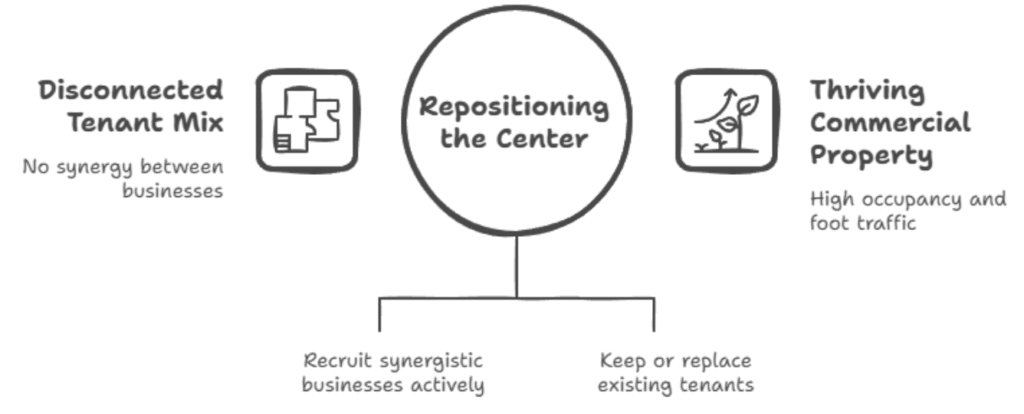

We spent the next 18 months thoughtfully repositioning that center. Some tenants we kept, others we didn’t renew, and we actively recruited businesses that would create synergy with each other. The transformation was remarkable – occupancy hit 95%, foot traffic increased dramatically, and existing tenants started seeing real growth in their sales. More importantly, the property’s value increased by nearly 30% over that period.

This experience reinforced something I’d suspected but hadn’t fully appreciated: location matters, but tenant mix can make or break a commercial property.

What Tenant Mix Strategy Really Means

Tenant mix strategy isn’t just about filling vacant spaces – though I’ll admit, when cash flow is tight, the temptation to take any qualified tenant is strong. Real tenant mix strategy is about deliberately curating a collection of businesses that enhance each other’s success and create value greater than the sum of their parts.

Think of it like putting together a dinner party. You don’t just invite anyone who’s available – you consider how the guests will interact, what they’ll talk about, whether they’ll enjoy each other’s company. The right mix creates energy and synergy that makes everyone want to stay longer and come back again.

In commercial real estate terms, this translates to selecting tenants who serve similar or complementary customer bases, whose business models support foot traffic generation, and whose brands align with the overall positioning you want for your property. It’s about creating destinations rather than just collections of individual businesses.

The process requires understanding your target market at a deeper level than most property owners bother with. It’s not enough to know that the area has families with median household income of $75,000. You need to understand their shopping patterns, their lifestyle preferences, what drives their purchasing decisions, and how they move through retail and office environments.

Why This Actually Matters to Your Bottom Line

Property Values and Cap Rates

Here’s something that might surprise you: two identical buildings with different tenant mixes can have significantly different values. I’ve seen this play out repeatedly in appraisals and sales. A property with a strategic tenant mix commands higher rents, achieves better lease terms, and attracts more investor interest than one with a random collection of tenants.

The connection to property value runs through Net Operating Income, but it’s more nuanced than just rental rates. Properties with strong tenant mixes typically achieve higher occupancy rates, longer average lease terms, and more predictable cash flows. These factors all influence how investors value the property and what cap rates they’re willing to accept.

I worked on an office building acquisition where this principle was clearly demonstrated. The building had two similar-sized floors with very different tenant compositions. The third floor housed a law firm, an accounting practice, a financial advisor, and a business consultant – all serving similar client bases with opportunities for referrals. The fourth floor had a random mix: a small manufacturer, a nonprofit organization, a telemarketing company, and some generic office users.

Guess which floor had higher occupancy, longer lease terms, and tenants willing to pay above-market rents? The collaborative professional services floor generated about 15% higher revenue per square foot, and those tenants stayed longer and caused fewer problems.

Tenant Retention and Stability

Tenant turnover is expensive and disruptive. Beyond the obvious costs of re-leasing space – marketing, broker commissions, tenant improvement allowances – there are hidden costs like lost rent during vacancy periods and the management time required to find and onboard new tenants.

Properties with thoughtful tenant mixes experience significantly lower turnover rates. When tenants benefit from each other’s presence, they’re more likely to renew their leases. It’s not just about the financial benefits – there’s a psychological component too. Tenants who feel like they’re part of a community rather than just renting space develop stronger attachments to their locations.

I’ve seen this principle work particularly well in retail environments. A shopping center I managed was struggling with constant tenant turnover in one section. We repositioned that area as a “wellness corridor” by recruiting a yoga studio, a health food store, a massage therapist, and a nutritionist. These businesses started cross-referencing clients to each other, collaborated on wellness events, and created a genuine sense of community. Lease renewals in that section went from about 60% to over 90%, and we stopped having vacancy problems.

The Traffic and Sales Connection

In retail properties especially, the right tenant mix creates what I call “trip chaining” – customers who come for one thing and end up visiting multiple businesses during the same trip. This multiplier effect benefits all tenants and makes the property more valuable to everyone involved.

The classic example is the grocery store anchor that brings people in for necessities, who then grab coffee, pick up dry cleaning, or stop at the pharmacy. But it works in more subtle ways too. I’ve noticed that certain tenant combinations create unexpected synergies – like the bookstore that thrives next to the coffee shop, or the children’s clothing store that does better when located near a family restaurant.

Office properties experience similar dynamics, though they’re less obvious. When complementary businesses locate near each other, they often develop informal referral relationships that benefit everyone. The marketing consultant refers clients to the graphic designer down the hall. The accountant recommends the business attorney on the next floor. These relationships create stickiness that’s hard to replicate.

Getting the Mix Right for Retail Properties

The Essential Services Foundation

Every successful retail property needs a foundation of essential services – businesses that people need regularly regardless of economic conditions. These tenants provide stability and consistent foot traffic that benefits everyone else in the property.

Grocery stores are the obvious anchor, but there are other essential services that work well: pharmacies, banks, dry cleaners, hair salons, and urgent care clinics. These businesses bring people to your property on a regular basis, creating opportunities for impulse purchases and planned stops at other tenants.

The key is balancing essential services with more discretionary businesses. Too many essential services and your property becomes purely utilitarian. Not enough, and you lack the stable traffic base that supports other tenants during slower periods.

I learned this lesson the hard way early in my career. I was managing a strip center that was anchored by a great independent grocery store, but most of the other tenants were restaurants and boutiques – businesses that people visit occasionally rather than regularly. When the local economy hit a rough patch, the discretionary spending dropped significantly, and several of those tenants struggled. We repositioned the center by adding a bank branch, a dry cleaner, and a cell phone store. The additional consistent traffic helped stabilize the entire property.

The Experience Factor

With e-commerce continuing to grow, brick-and-mortar retail needs to offer something that online shopping can’t: experiences. This has led to the rise of experiential retail – businesses that provide services, entertainment, or experiences rather than just products.

Fitness studios, cooking classes, art galleries, entertainment venues, and unique dining concepts all fall into this category. These businesses create reasons for people to choose your property over online alternatives or other retail locations.

But experiential retail works best when it’s integrated thoughtfully with other tenant types. A painting studio might struggle on its own but thrive next to a wine bar and a boutique gift shop, creating an “evening out” destination. A children’s play center makes sense near family restaurants and kid-focused retail.

The challenge with experiential tenants is that they often require different lease structures than traditional retail. Many of these businesses have variable income streams and may need more flexible terms or revenue-sharing arrangements. But when they work, they can transform a property’s appeal and create genuine differentiation in the market.

Office Property Strategies

Building Business Ecosystems

Office tenant mix strategy is less about foot traffic and more about creating environments where businesses can thrive and grow. The best office properties become business ecosystems where tenants benefit from proximity to each other.

I’ve found that clustering complementary professional services often works well. Law firms, accounting practices, financial advisors, and business consultants serve similar client bases and can refer business to each other. Technology companies, creative agencies, and startups often benefit from being near each other – they share talent pools, collaborate on projects, and create innovation-friendly environments.

But you have to be careful about competition versus collaboration. Two accounting firms targeting the same market might not want to be in the same building, while an accountant and a business attorney could develop a mutually beneficial relationship.

The physical layout matters too. Properties with common areas, conference facilities, and flexible spaces tend to foster more interaction between tenants. I’ve seen buildings where the simple addition of a high-quality coffee shop in the lobby created opportunities for tenant interaction that led to business relationships.

Amenities as Tenant Mix

Modern office tenants increasingly view amenities as essential rather than nice-to-have features. But amenities can also be thought of as part of your tenant mix – services that enhance the appeal of your property and create additional revenue streams.

On-site fitness facilities, child care centers, restaurants, dry cleaning services, and even medical/dental practices can serve as both amenities for other tenants and profit centers for property owners. The key is selecting amenities that align with your tenant base and location.

I worked on repositioning an older office building that was losing tenants to newer properties with better amenities. Instead of expensive renovations, we recruited a high-end fitness center, a gourmet food hall, and a full-service business center as tenants. These additions served as amenities for other tenants while paying rent and contributing to the property’s NOI. Occupancy rates improved significantly, and we were able to raise rents across the building.

Measuring Success and Making Adjustments

The Numbers That Matter

Tracking the success of your tenant mix requires looking beyond basic occupancy rates. For retail properties, I monitor foot traffic patterns, sales per square foot for tenants willing to share that data, and customer dwell time. For office properties, I track lease renewal rates, tenant satisfaction scores, and referral activity between tenants.

But some of the most important indicators are qualitative. Are tenants collaborating with each other? Are they attending property-sponsored events? Do they speak positively about the property and their fellow tenants? These soft metrics often predict future hard metrics like renewal rates and referral activity.

I also pay attention to external indicators like online reviews, social media engagement, and local press coverage. Properties with strong tenant mixes often generate positive buzz that attracts both customers and potential new tenants.

Staying Flexible

Market conditions change, consumer preferences evolve, and individual tenant performance varies. The most successful tenant mix strategies build in flexibility to adapt to these changes over time.

This might mean including shorter-term lease options for certain tenant types, maintaining relationships with potential replacement tenants, or designing spaces that can accommodate different uses. It definitely means staying connected to market trends and being willing to make changes when current strategies aren’t working.

I’ve learned not to get too attached to any particular tenant mix vision. What works in one market cycle might not work in the next. The key is having clear principles about what you’re trying to achieve while remaining flexible about how you achieve it.

The Reality of Implementation

Creating an optimal tenant mix sounds straightforward in theory, but implementation can be challenging. Existing leases limit your flexibility, market conditions affect tenant availability, and cash flow pressures sometimes force compromises on ideal tenant selection.

The key is taking a long-term perspective and making incremental improvements over time. Every lease renewal is an opportunity to reassess whether that tenant still fits your strategy. Every new lease is a chance to move closer to your ideal mix.

Sometimes this means saying no to tenants who can pay the rent but don’t fit your vision. I know how difficult this can be, especially when you’re dealing with vacancies and cash flow pressures. But I’ve consistently found that properties with strategic tenant mixes outperform those with purely opportunistic leasing over the long term.

The best tenant mix strategies are collaborative efforts involving property owners, leasing agents, property managers, and sometimes even existing tenants. Everyone needs to understand the vision and work toward common goals. When it works, the results speak for themselves in improved occupancy, higher rents, stronger tenant relationships, and increased property values.

Tenant mix strategy requires patience, market knowledge, and sometimes the courage to make short-term sacrifices for long-term gains. But for property owners willing to invest the time and effort, it remains one of the most effective ways to differentiate their properties and maximize returns in competitive markets.