Look around any major city today, and you’ll see cranes dotting the skyline, new apartment complexes rising from former parking lots, and once-quiet neighborhoods buzzing with activity. We’re living through one of the most significant population shifts in human history – people are flocking to cities at an unprecedented rate.

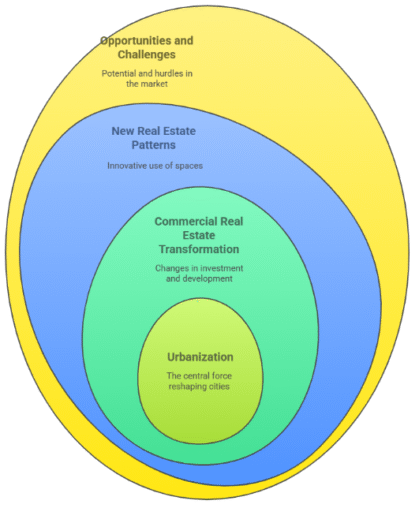

I’ve been working in commercial real estate for over a decade, and I can tell you that urbanization isn’t just changing where people live. It’s completely transforming how we think about commercial property investment, development, and demand. The old rules don’t apply anymore.

When I started in this business, you could predict commercial real estate patterns pretty easily. Office buildings went downtown, shopping centers sat in the suburbs, and warehouses stayed on the outskirts. Today? A former factory might house tech startups, ground-floor retail spaces double as community gathering spots, and distribution centers compete for prime urban real estate.

This shift creates massive opportunities – and significant challenges. If you’re investing in commercial real estate or thinking about it, understanding these urban dynamics isn’t just helpful. It’s absolutely critical for your success.

Understanding Urbanization and Its Drivers

Here’s what’s really happening: urbanization goes way beyond people simply moving from farms to cities. What we’re seeing is the concentration of economic power, innovation hubs, and diverse communities all packed into relatively small geographic areas. This density is what drives commercial real estate demand.

The numbers tell the story. Cities offer something rural areas can’t – job diversity and higher wages. When a major tech company sets up headquarters in Austin or a financial firm expands in Charlotte, they create a ripple effect. Suddenly, you need restaurants for all those workers, retail spaces for their shopping, and service businesses to support their lifestyles.

But it’s not just about economics. Cities provide cultural attractions, top-tier universities, robust public transportation, and social networks that rural areas struggle to match. I’ve seen small cities transform almost overnight when they successfully attract young professionals. The commercial real estate follows the people, and the cycle accelerates.

The Direct Impact on Different CRE Sectors

Not all commercial properties benefit equally from urbanization. The impact varies dramatically depending on the property type, and understanding these differences can make or break your investment strategy.

Office Real Estate

The office sector tells a fascinating story about urban evolution. For years, central business districts dominated office demand. Companies wanted prestigious downtown addresses to attract top talent and project success. That’s still partially true, but the game has changed significantly.

I recently worked with a client who was dead set on a suburban office park to save money. After analyzing their workforce demographics – mostly millennials and Gen Z professionals who lived in the city – we pivoted to a smaller but better-connected urban location. Yes, the rent was higher, but employee satisfaction improved, recruitment became easier, and they actually saved money on turnover costs.

Today’s urban office demand focuses heavily on quality and experience. Companies want buildings with modern amenities, flexible layouts for collaboration, and easy access to restaurants, gyms, and public transit. The “flight to quality” trend means that generic office space, even in urban areas, struggles while well-designed, amenity-rich buildings see strong demand.

The rise of hybrid work has actually strengthened this trend. When employees only come to the office a few days per week, companies want that experience to be exceptional. They’re willing to pay premium rents for spaces that truly enhance productivity and company culture.

Retail Real Estate

Retail has undergone the most dramatic transformation. The suburban mall model that dominated for decades is largely dead, but urban retail is thriving – it just looks completely different.

Successful urban retail today is all about experience and convenience. I’ve watched neighborhoods transform when the right mix of retail moves in. Ground-floor spaces in new residential buildings perform exceptionally well when they offer services residents actually use – coffee shops, dry cleaners, fitness studios, and grocery stores.

The best urban retail creates community gathering spaces. Think about successful areas like Chicago’s Gold Coast or certain Los Angeles neighborhoods. These aren’t just places to buy things; they’re destinations where people want to spend time. The retail supports the lifestyle that draws people to urban living.

Location matters more than ever. Prime spots in walkable urban districts maintain low vacancy rates and see consistent rent growth. I’ve seen retail spaces in the right urban locations command rents that would have seemed impossible just five years ago.

Industrial Real Estate

This might surprise you, but urbanization has created massive demand for industrial space in and around cities. The driver? E-commerce and last-mile delivery.

When people live in dense urban areas, they expect fast delivery. Amazon didn’t create this expectation by accident – they recognized that urban consumers would pay for convenience. This has created fierce competition for industrial properties that can serve urban populations quickly.

I once worked with a logistics company that needed urban warehouse space. The lack of available properties near their target delivery zones was shocking. We ended up exploring creative solutions like multi-story warehouses and converted buildings because traditional industrial space simply wasn’t available at reasonable prices.

This scarcity drives up land values and forces innovation. Multi-story industrial buildings, underground distribution centers, and creative adaptive reuse projects are becoming common in high-demand urban markets.

Other CRE Types

Urbanization affects specialty properties too. Urban hotels see increased demand from business travelers and tourists attracted to city amenities. Healthcare facilities benefit from concentrated populations, especially as urban demographics skew younger and more health-conscious.

Data centers need to move closer to urban users to reduce latency for applications and services. Even niche properties like urban storage facilities or pet care centers can thrive in dense populations with specific needs.

Emerging Trends and Opportunities in Urbanizing Areas

Smart investors and developers are recognizing that urbanization creates entirely new categories of opportunity. These aren’t just modifications of existing property types – they’re fundamentally different approaches to meeting urban needs.

The Rise of Mixed-Use Developments

Mixed-use development has become the gold standard for urban projects, and for good reason. Instead of separating residential, retail, and office uses, successful urban projects integrate them seamlessly.

I’ve watched mixed-use projects transform neighborhoods. When residents can walk downstairs for coffee, grab lunch near their office, and shop for groceries on their way home, it creates incredible vibrancy. These projects generate foot traffic throughout the day, supporting retail tenants and creating the kind of urban energy that attracts more development.

The key is getting the mix right. Too much retail creates vacancy, too little fails to serve the community. Successful projects require careful market analysis and often involve complex zoning negotiations, but the results speak for themselves.

Adaptive Reuse and Repurposing

Cities are full of underutilized buildings with incredible potential. Old factories, abandoned retail centers, historic warehouses – these properties often offer unique character and strategic locations at relatively affordable prices.

I’ve seen remarkable transformations. A former textile factory becomes premium office space with exposed brick and high ceilings that new construction can’t replicate. An old department store gets converted into a mixed-use hub with retail, office, and residential components.

Adaptive reuse projects require creativity and often patience with regulatory processes, but they offer several advantages. Construction costs can be lower, the environmental impact is reduced, and the finished product has character that attracts tenants willing to pay premium rents.

The Growth of Secondary and Tertiary Cities

While everyone focuses on New York, San Francisco, and Los Angeles, some of the best opportunities exist in smaller cities experiencing rapid growth. Places like Raleigh, Austin, Nashville, and Portland have seen tremendous urban development as people and businesses seek more affordable alternatives to major metropolitan areas.

These markets often offer better value propositions for both businesses and residents. Office rents might be half of what you’d pay in Manhattan, but you still get access to skilled workers, cultural amenities, and growing business networks.

The key is identifying these markets early. By the time everyone recognizes a secondary city’s potential, property values have usually adjusted accordingly.

Challenges and Considerations

Urbanization creates incredible opportunities, but it also introduces complex challenges that can derail projects and investments if you’re not prepared.

Land costs represent the biggest hurdle in most urban markets. Prime locations command premium prices, and development costs continue escalating. I’ve seen projects killed because land acquisition consumed too much of the budget, leaving insufficient funds for quality construction.

Infrastructure strain is another major concern. Rapid urban growth often outpaces infrastructure development. Traffic congestion, utility capacity, and public services can become bottlenecks that impact property values and tenant satisfaction.

Regulatory complexity adds another layer of difficulty. Urban areas typically have more restrictive zoning, historic preservation requirements, and environmental regulations. I once worked on a project where historic district approvals added eight months to the timeline and significant costs for facade preservation.

Community relations matter more in urban settings. Neighborhoods have established identities and active resident groups who can support or oppose development projects. Successful urban development requires genuine community engagement, not just regulatory compliance.

Navigating the Urbanization Wave (My Strategic Approach)

Success in urban commercial real estate requires a different approach than traditional suburban development. Here’s what I’ve learned works.

Deep Local Market Analysis is Paramount

Cities aren’t uniform markets. Each neighborhood, sometimes each block, has distinct characteristics that affect commercial real estate demand. I spend considerable time analyzing submarket dynamics – demographic trends, planned infrastructure improvements, zoning changes, and local business patterns.

For example, one neighborhood might be perfect for creative office space near transit connections, while an adjacent area better suits last-mile distribution due to highway access. You can’t make good decisions without understanding these micro-market differences.

Identifying Niche Opportunities

Urban markets create specialized demand that doesn’t exist in suburban or rural areas. Dense populations with diverse needs create opportunities for property types you might not consider elsewhere.

I once advised a client to acquire a small building near a major hospital complex and convert it to specialized medical office space. This wasn’t a glamorous investment, but it served a clear, underserved demand from healthcare professionals and patients. The project generated excellent returns because we identified a specific urban need.

Embrace Flexibility and Adaptive Strategies

Urban markets change quickly. Properties that can adapt to different uses maintain value better than single-purpose buildings. When designing or acquiring urban properties, I always consider flexibility – can spaces be reconfigured, can the building serve different tenants, are the infrastructure and layout adaptable?

I’ve seen building owners save projects by quickly pivoting when market conditions changed. Flexible design and infrastructure make these pivots possible.

Partnerships and Collaboration

Urban development involves multiple stakeholders – city planners, community groups, existing businesses, and sometimes competing developers. Building relationships and fostering collaboration leads to better outcomes than adversarial approaches.

Early engagement with community leaders and city officials helps identify potential issues before they become problems. I’ve seen developers waste months fighting battles that could have been avoided with better upfront communication.

Urbanization represents the most significant force shaping commercial real estate today. The demographic shift toward cities drives demand across all property types, but the effects vary dramatically depending on location, property type, and execution.

The opportunities are substantial for investors and developers who understand urban dynamics. Mixed-use development, adaptive reuse, and niche market opportunities can generate exceptional returns. Secondary and tertiary cities offer particular value as they experience rapid growth without the cost pressures of major metropolitan areas.

However, success requires a sophisticated approach. Urban markets demand deep local knowledge, flexibility, and collaborative relationships. The regulatory environment is more complex, community engagement is essential, and infrastructure constraints can impact project viability.

The future of commercial real estate is urban. Population trends, economic concentration, and lifestyle preferences all point toward continued city growth. By understanding these dynamics and developing appropriate strategies, commercial real estate professionals can not only navigate the urbanization wave but profit significantly from the opportunities it creates.

The cities of tomorrow are being built today. The question isn’t whether urbanization will continue – it’s whether you’ll position yourself to benefit from this massive transformation.