When I first started looking into commercial real estate investing, I felt completely overwhelmed. There I was, scrolling through listings for office buildings, apartment complexes, and warehouse spaces, wondering how the heck anyone decides where to put their money first. The truth is, jumping into CRE without a game plan is like trying to navigate a new city without a map – you might eventually get somewhere, but you’ll probably take a lot of wrong turns along the way.

After years in this business and plenty of lessons learned the hard way, I’ve come to realize that picking your first commercial property isn’t about finding the “perfect” deal everyone talks about. It’s about finding the right fit for where you are right now – your budget, your time, your comfort level with risk, and honestly, what you can actually handle without losing sleep.

Understanding the Landscape: What ARE CRE Asset Classes?

Before we get into the nitty-gritty of which property type might work for you, let’s talk about what we’re actually dealing with. Commercial real estate isn’t just “business properties” – it’s a whole ecosystem of different property types, each with its own personality and quirks.

Each of these asset classes operates differently. Multifamily properties are all about housing people – you’re dealing with tenants who need a place to live. Retail properties depend on foot traffic and consumer spending. Office buildings rise and fall with business trends and employment rates. Industrial properties are tied to logistics and manufacturing needs. Self-storage facilities serve a more niche market but can be surprisingly steady.

The key thing to understand is that these aren’t just different types of buildings – they’re different types of businesses. And picking your first one means picking which type of business you want to learn first.

More Than Just Returns: Key Factors for Your First CRE Investment

Here’s where a lot of new investors get tripped up. They see some flashy case study about a 20% cash-on-cash return and think that’s all that matters. Don’t get me wrong – returns are important. But when you’re starting out, there are several other factors that can make or break your experience.

Upfront Capital and Financing

Let’s talk money first, because that’s usually what stops people in their tracks. Different types of commercial properties require vastly different amounts of cash upfront. A small duplex might let you get started with 20-25% down, while a retail plaza could require 30% or more – and we’re talking about much larger purchase prices.

I learned this lesson early when I found what I thought was the perfect deal on a small office building. Great location, solid tenants, reasonable asking price. Then I talked to lenders and realized the down payment alone would wipe out most of my available capital, leaving me with no reserves for repairs or vacancy. That’s when it hit me – it’s not just about having enough for the down payment, it’s about having enough left over to actually operate the property.

Commercial financing is also more complex than residential mortgages. Lenders look at the property’s income potential, your experience level, and the specific asset class when determining terms. Some property types are considered lower risk by lenders, which can mean better rates and terms for you.

Management Intensity and Required Skill Set

This is where the rubber meets the road. Some commercial properties are genuinely more hands-off, while others will have you fielding calls at 9 PM on a Sunday. The difference comes down to the type of tenants you’re dealing with and what they expect from their landlord.

Managing a single-tenant industrial building with a long-term lease is completely different from managing a 12-unit apartment building with monthly turnovers. One might require quarterly check-ins, while the other could have you dealing with maintenance requests, tenant complaints, and lease renewals on a weekly basis.

I’ve seen too many new investors underestimate this aspect. They buy a property thinking they’ll just collect rent checks, then find themselves spending 15 hours a week on property management tasks they never anticipated. Be honest with yourself about how much time you actually have and what you’re willing to do.

Risk Profile (Market & Property Specific)

Every investment carries risk, but the types of risks vary dramatically between property types. A retail property’s success depends heavily on consumer spending and local economic conditions. If the economy tanks, retail tenants might struggle to pay rent or close their businesses entirely.

Compare that to a well-located self-storage facility. People need storage during good times and bad – they downsize during tough times, upsize during good times. The demand tends to be more stable across economic cycles.

Then there are property-specific risks. Losing a single tenant in a small office building could mean 50% vacancy overnight. Losing one tenant in a 20-unit apartment building means 5% vacancy. The impact on your cash flow is dramatically different.

Market Knowledge and Learning Curve

Some property types are easier to understand and analyze than others, especially when you’re starting out. Residential income properties benefit from having a large pool of comparable sales and rental data. Most people understand what makes an apartment desirable, what rents should be, and how to evaluate the neighborhood.

Try evaluating an industrial property or a specialty retail space, and suddenly you’re dealing with much more complex market dynamics. How do you determine market rent for a 5,000 square foot warehouse? What makes one industrial location better than another? These questions have answers, but finding them requires specialized knowledge that takes time to develop.

Personal Interest and Goals

This might sound touchy-feely, but it matters more than you think. Your first commercial property investment is going to be a learning experience, and learning is a lot easier when you’re genuinely interested in the subject matter.

If you hate dealing with people, managing apartment tenants is going to be miserable. If you find logistics and warehousing fascinating, industrial properties might be a natural fit. If you have a retail background, you might have insights into what makes a good retail location that others would miss.

Your long-term goals matter too. Are you looking to build a passive income stream, or do you want to be actively involved in property management? Are you planning to scale up quickly, or is this more about learning the ropes? Different property types align better with different goals.

Analyzing the Options: Which Asset Classes Lend Themselves (or Don’t) to Beginners

Now let’s get into the specifics. Using the factors we just discussed, let’s look at how different property types stack up for someone making their first commercial real estate investment.

Multifamily (Residential Income)

Small multifamily properties – think duplexes, triplexes, small apartment buildings – are probably the most common starting point for new commercial investors. There’s a good reason for this: they’re familiar. Most people understand residential real estate, and the concept of being a residential landlord feels manageable.

The financing can be more accessible too, especially for smaller properties. You might be able to use residential lending programs for properties with four units or fewer, which often means lower down payments and better terms than commercial loans.

But here’s the reality check: multifamily can be management-intensive. You’re dealing with individual tenants who each have their own needs, problems, and personalities. Maintenance requests come in regularly. Tenant turnover means marketing vacant units, screening applicants, and handling move-ins and move-outs.

The numbers can work well, especially in strong rental markets. You’re spreading risk across multiple units, so one vacancy doesn’t kill your cash flow. But be prepared to either spend significant time on management or budget for professional property management from day one.

Small Bay Industrial / Flex

This is a category that doesn’t get talked about enough, but it can be an interesting option for beginners. Small industrial buildings, often divided into multiple units or combining warehouse and office space, offer some unique advantages.

Many industrial leases are structured as triple-net leases, meaning the tenant pays property taxes, insurance, and maintenance costs directly. This can significantly reduce your management burden and make your expenses more predictable.

The tenants are typically businesses rather than individuals, which can mean more stable, professional relationships. Business tenants often stay longer and take better care of the property than residential tenants.

The downside is that you’re now dealing with commercial leases, which are more complex than residential leases. You need to understand the local industrial market, which requires different knowledge than residential real estate. And finding good small industrial properties can be challenging in some markets.

Self-Storage

Self-storage facilities get a lot of attention in investing circles because they’re perceived as relatively passive investments. The operational model is straightforward: rent out storage units, collect payments, handle security and access.

Compared to residential rentals, tenant needs are minimal. No maintenance requests for broken appliances or leaky faucets. No noise complaints between units. Evictions, while still possible, are typically less complex than residential evictions.

The challenge with self-storage is that success is heavily location-dependent. You need to understand local demographics, competition, and demand patterns. The initial due diligence can be complex, and ongoing marketing to keep units filled requires a different skill set than traditional property management.

Self-storage can work well for investors who want lower day-to-day management intensity but are willing to focus on marketing and customer acquisition.

Retail (Small Scale)

Small retail properties – maybe a single storefront or a unit in a neighborhood shopping center – can seem appealing because the concept is straightforward. Business rents space, pays rent, everyone’s happy.

The reality is more complicated. Retail is heavily tied to economic conditions and consumer trends. When times get tough, retail businesses are often the first to struggle. Empty storefronts are a visible reminder of how quickly retail can change.

Finding replacement tenants for retail space can be challenging and time-consuming. Each retail space has unique characteristics that work for some businesses but not others. A space that worked perfectly for a restaurant might be completely wrong for a clothing store.

Commercial retail leases can also be complex, sometimes involving percentage rent based on the tenant’s sales. While this can be upside when business is good, it adds another layer of complexity to manage.

Unless you have specific experience or advantages in retail, it’s probably not the best starting point for most new investors.

Office

Office properties, especially larger buildings, typically aren’t suitable for beginners. The capital requirements are usually much higher than other property types. Commercial office leases are complex and often involve significant tenant improvement allowances that the landlord pays for.

Managing office buildings requires understanding sophisticated building systems, common area maintenance, and the needs of business tenants. The current office market is also facing unique challenges with remote work trends changing demand patterns.

For most people starting out, office properties represent too high a barrier to entry in terms of both capital and complexity.

Finding YOUR Best Starting Point: Synthesizing Your Situation and the Market

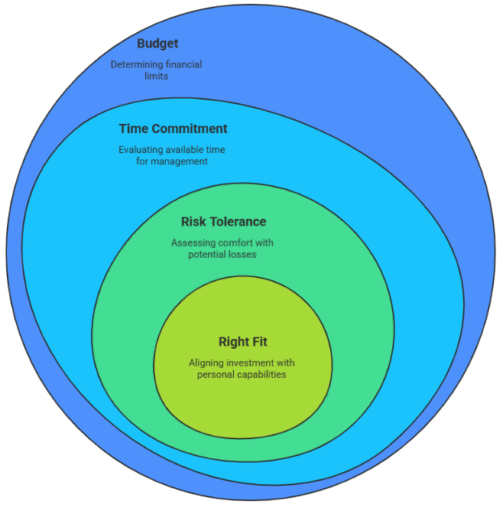

So how do you actually decide? It comes down to honest self-assessment and matching your situation to the right property type.

Ask Yourself the Right Questions

Start with these fundamental questions:

Capital: How much money do you realistically have available for a down payment, closing costs, and reserves? Don’t forget about reserves – they’re crucial for handling unexpected expenses or vacancy periods.

Time: How much time can you realistically dedicate to property management each week? Be honest about your current commitments and what you’re actually willing to take on.

Risk Tolerance: How would you handle a major vacancy or unexpected expense? What’s your ability to weather difficult periods without panicking?

Skills and Interest: What are your existing strengths? What type of property genuinely interests you? Which asset class feels most understandable given your background?

Goals: What are you trying to achieve with this investment? Cash flow? Long-term appreciation? Learning experience? Different property types align better with different goals.

Matching Your Profile to the Asset Class

Once you’ve answered these questions honestly, you can start matching your profile to different property types. If you have limited capital but plenty of time and enjoy working with people, a small multifamily property might make sense. If you have more capital but limited time, self-storage might be a better fit.

The key is being realistic about your constraints and capabilities. There’s no point in forcing yourself into a property type that doesn’t match your situation, no matter how attractive the potential returns look on paper.

The Importance of Local Market Conditions

Even after you’ve identified property types that match your profile, you still need to evaluate local market conditions. The best property type in the world can be a terrible investment in the wrong market.

Research local supply and demand for your chosen property type. Are there waiting lists for apartments, or are vacancy rates climbing? Is there oversupply of self-storage facilities, or is the market underserved? Local market analysis is just as important as choosing the right property type.

Starting your commercial real estate journey is exciting, but choosing the right property type to begin with can make all the difference in your experience and long-term success. There’s no universal “best” starting point – the right choice depends entirely on your financial situation, available time, risk tolerance, and personal goals.

Do your homework, be honest about your capabilities and constraints, research your local market thoroughly, and then take action. Your first commercial property investment is just the beginning of what could be a very rewarding journey in real estate investing.